AvaTrade Philippines Review

AvaTrade is a leading online broker that offers a wide range of trading instruments, including forex, stocks, commodities, indices, and cryptocurrencies. The Central Bank of Ireland regulates AvaTrade, and it is also a member of the Investment Industry Regulatory Organization of Canada (IIROC). AvaTrade Philippines provides a secure and reliable trading environment with competitive spreads, low commissions, and a wide range of trading tools and features. AvaTrade Philippines Review will provide an in-depth look at its features, fees, customer service, and more.

How to Get Started with AvaTrade Philippines

To start with AvaTrade Philippines, you need to open an account. You can easily do this online. After opening the account, you will have to deposit an initial amount via bank transfer, credit card, or other payment methods.

Once you have funded your account, you can start trading. AvaTrade Philippines provides a variety of trading platforms, including MetaTrader 4 and 5. These platforms offer users access to a wide range of markets and instruments, along with advanced charting and analysis tools.

AvaTrade Philippines also provides educational resources such as webinars, tutorials, and e-books to help users learn about trading and investing. Additionally, AvaTrade Philippines offers customer support services via live chat, email, telephone, and a comprehensive FAQ section.

By following these steps, you can begin trading and investing in the financial markets with AvaTrade Philippines.

AvaTrade Account Types

AvaTrade broker that provides various types of accounts to cater to the diverse needs of its clients. In the Philippines, AvaTrade offers the following types of accounts:

- AvaTrade Demo Account: This type of account is perfect for beginners who are still learning the ropes of forex trading. It allows users to practice their trading strategies without risking their real money. The AvaTrade demo account comes with virtual funds that you can use to simulate real trading conditions.

- Standard Account: The standard account is the most common type of account in AvaTrade. It requires a minimum deposit of $100. It allows traders to trade in standard lots and offers a variety of features such as access to trading signals, educational resources, and customer support.

- AvaTrade Islamic Account: This account is specifically designed for traders who follow the Islamic faith and want to trade according to the principles of Sharia law, which prohibits earning or paying interest rates. The AvaTrade Islamic account is a swap-free account, meaning there are no overnight or rollover charges on positions held overnight.

- Professional Account: The professional account is designed for experienced traders who meet specific criteria in terms of trading volume and size. It offers lower margin requirements and access to additional trading tools and resources. However, it also comes with higher risks.

FInancial Assets Available

- Indices: These are groups of stocks that represent a particular market or section of the market. Investors use them to gauge the overall health of the market and compare individual investments to the market as a whole. AvaTrade offers trading in a variety of global indices.

- FXOptions: These are derivative financial instruments that give the right, but not the obligation, to exchange money denominated in one currency into another currency at a pre-agreed exchange rate on a specified future date.

- Commodities: These include physical goods like gold, oil, natural gas, and agricultural products. Traders can speculate on the price movements of these goods without having to physically own them.

- Forex Pairs: Forex trading involves buying one currency while simultaneously selling another. This is done in pairs, such as EUR/USD, GBP/USD, etc. AvaTrade offers a wide range of forex pairs for trading.

- ETFs: Exchange-Traded Funds are investment funds and exchange-traded products, with tradable shares on a stock exchange. They offer an effective way to diversify your portfolio.

- Stocks: AvaTrade offers thousands of stocks from all major stock exchanges. It allows people to speculate on the price movements of individual company shares.

- Bonds: These are debt securities, similar to IOUs. When you purchase a bond, you are lending money to the issuer in exchange for periodic interest payments and the return of the bond’s face value when it matures.

- Vanilla Options: These are basic options with no special features, conditions, or provisions. They give the holder the right, but not the obligation, to buy or sell an underlying asset at a predetermined price within a given timeframe.

- Cryptocurrencies: AvaTrade offers trading in various digital currencies including Bitcoin, Ethereum, Litecoin, and others. Cryptocurrency is a digital or virtual currency that uses cryptography for security. It operates independently of a central bank.

AvaTrade Deposit Options in the Philippines

AvaTrade broker provides several deposit options for users in the Philippines. Here are some of the deposit options available:

- Credit/Debit Cards: One of the most common deposit methods is through credit or debit cards. AvaTrade accepts major cards such as Visa, MasterCard, Maestro, and more.

- Bank Wire Transfer: You can also deposit money via Bank Wire Transfer. This involves transferring funds directly from your bank account to your AvaTrade account.

- E-Wallets: AvaTrade also accepts deposits through various e-wallets. This includes popular options like Skrill, Neteller, and WebMoney.

- Cryptocurrencies: For those who have ventured into the world of digital currencies, AvaTrade allows deposits through Bitcoin and other cryptocurrencies.

- AvaTradeGO App: You can also deposit through the AvaTradeGO app. This mobile trading app allows you to manage your account and make deposits on the go.

Remember, it’s important to check the processing time, as well as any potential fees. AvaTrade minimum deposit amount depends on the base currency of your account. Be sure to review AvaTrade’s deposit and withdrawal policy for more information.

AvaTrade Withdrawal Options in the Philippines

AvaTrade Philippines provides its clients with a variety of withdrawal options. These options are designed to make it easy and convenient for clients in different parts of the world, including the Philippines, to access their funds.

- Credit/Debit Cards: AvaTrade allows clients to withdraw funds using their credit or debit cards. This is one of the most convenient options as it allows for instant withdrawals.

- Bank Wire Transfer: This option allows clients to transfer funds directly to their bank account. While it might take a few days for the transfer to be completed, it is a secure and reliable option.

- E-Wallets: AvaTrade also accepts withdrawals through e-wallets like PayPal, Skrill, and Neteller. These are convenient and fast options, especially for clients who do not have a bank account.

- AvaTrade Debit MasterCard: AvaTrade also provides a Debit MasterCard to its clients. This card can be used to make withdrawals at ATMs worldwide.

In terms of the AvaTrade minimum withdrawal amount, the broker allows clients to withdraw at least $100 for credit/debit cards and e-wallets, and a minimum of $500 for bank wire transfers. These minimum amounts are in place to ensure that the withdrawal process is efficient and cost-effective for both AvaTrade and its clients. Please note that AvaTrade might charge a withdrawal fee in certain cases, so it is recommended to check their website or contact their customer service for the most accurate information.

Fees and Commissions

AvaTrade Philippines provides its clients with competitive fees and commissions. The fees and commissions are dependent on the type of account and the instrument being traded.

- Forex: no commission | spreads from 0.9 pips

- CFDs: 0.04% commission of the total trade value | a minimum fee of $4

- Stocks: no commission | spreads from 0.1%

- ETFs: 0.1% commission of the total trade value | $4 minimum fee

- Commodities: no commission | spreads from 0.1%

- Indices: 0.04% commission | $4 minimum fee

Additionally, AvaTrade Philippines charges an inactivity fee of $50 per month for accounts that have been inactive for more than three months.

Overall, traders looking to trade in the Philippines can find AvaTrade Philippines an attractive option as it provides competitive fees and commissions.

Trading Platforms

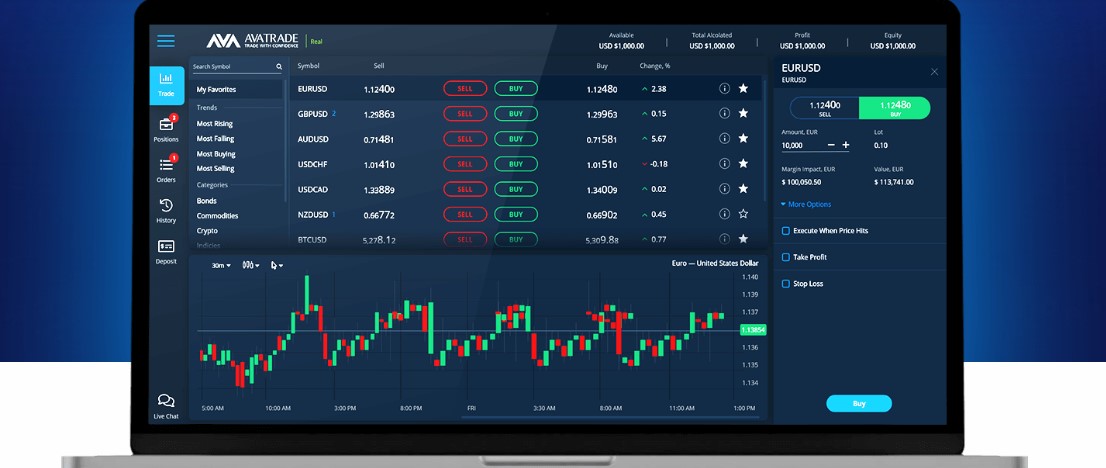

AvaTrade is a renowned online trading platform that offers several trading platforms for its users in the Philippines. Here are some of the platforms they provide:

- WebTrader: AvaTrade’s WebTrader is a user-friendly platform that allows traders to access their account from any web browser. This platform is perfect for both beginners and experienced traders, as it provides a wide range of trading tools and features.

- AvaOptions: This is a unique trading platform offered by AvaTrade. It allows traders to trade Forex options, a financial instrument that allows traders to speculate on the future price of a currency pair. AvaOptions provides a variety of trading strategies for both new and experienced traders.

- AvaTrade App: A mobile trading app that allows traders to trade anytime, anywhere. The app is available for both iOS and Android devices and offers a wide range of features, including real-time price updates, a variety of trading tools, and access to more than 250 trading instruments.

- Mac Trading: AvaTrade also caters to Mac users with a platform specifically designed for Mac operating systems. This platform offers a seamless trading experience with a user-friendly interface and a range of trading tools and features.

- MetaTrader 4: AvaTrade MT4 (MetaTrader 4), is a popular trading platform known for its analytical capabilities. MT4 offers advanced charting capabilities, multiple order types, and a variety of tools and indicators for technical analysis.

- MetaTrader 5 (AvaTrader MT5): Provides its users with the option to use MetaTrader 5, the newer version of the popular MetaTrader platform. MT5 offers all the features of MT4, along with some additional ones such as more timeframes, advanced trading tools, and a wider range of instruments to trade with.

These platforms by AvaTrade offer traders in the Philippines a wide range of options to choose from according to their trading needs and preferences.

Customer Support Services

AvaTrade Philippines offers a variety of customer support services to ensure that clients receive the best possible service. These services include:

- Live Chat: AvaTrade Philippines offers a live chat service that enables clients to communicate with them in real-time. Clients can use this service 24/7 and it is the fastest means of seeking assistance for any concerns or inquiries.

- Phone Support: This allows clients to speak directly with customer service representatives. This service is available from Monday to Friday, 8 am to 5 pm.

- Email Support: Clients can also contact AvaTrade Philippines via email. This service is available 24/7 and is the best way to get assistance with more complex queries or issues.

- Online Support: The online support service allows clients to access a range of helpful resources such as FAQs, tutorials, and more. This service is available 24/7 and is the best way to get assistance with more general queries or issues.

AvaTrade Philippines Pros & Cons

Pros

- Security: The Philippine Securities and Exchange Commission (SEC) regulates AvaTrade Philippines, ensuring the security of all transactions and the protection of clients’ funds.

- Variety of Trading Platforms: Offers a variety of trading platforms, including the popular MetaTrader 4 and 5, as well as its own proprietary platform, AvaTradeGo. This allows traders to choose the platform that best suits their needs.

- Low Fees: Offers competitive spreads and low fees, making it an attractive option for traders.

- Education and Support: Provide educational resources and support to help traders learn the basics of trading and develop their skills.

Cons

- Limited Asset Selection: This has a limited selection of assets, which may not be suitable for all traders.

- Limited Leverage: Offers limited leverage, which may not be suitable for traders who are looking to take on more risk.

- Limited Customer Support: Limited customer support, may not be suitable for traders who need more assistance.

Is AvaTrade Legal in the Philippines?

The Securities and Exchange Commission (SEC) of the Philippines regulates AvaTrade, a legal forex broker in the Philippines. Additionally, it is a member of the Philippine Investor Protection Fund (PIPF) and the Financial Commission, an independent dispute resolution organization.

AvaTrade offers a variety of trading instruments, such as Forex, CFDs, stocks, indices, commodities, and cryptocurrencies, and provides several trading platforms, including MetaTrader 4 & 5, AvaTradeGo, and AvaOptions.

Furthermore, AvaTrade offers educational resources such as webinars, tutorials, and eBooks. The broker is committed to ensuring the safety of its client’s funds and has implemented measures such as segregated accounts, negative balance protection, and advanced encryption technology.

Overall, AvaTrade provides a secure trading environment and a wide range of trading instruments and platforms as a legitimate Forex broker in the Philippines.

AvaTrade Philippines Review – Conclusion

Those looking to trade in the Philippines can choose AvaTrade Philippines, which provides a wide range of trading options, competitive spreads, and a secure trading environment. The company also offers excellent customer service, with a team of knowledgeable and friendly staff available to assist with any queries. Overall, AvaTrade Philippines is a great option for traders in the Philippines.

Check out our reviews of other recommended forex brokers in the Philippines.

easyMarkets Philippines | Exness Philippines Review | FBS in the Philippines Review