How to Trade Binary Options in Philippines

Binary options trading has become increasingly popular among Filipino traders looking for short-term, high-return opportunities. With low capital requirements and simple trading mechanics, it appeals especially to beginners. However, success requires proper guidance, risk management, and understanding of the process.

In this complete guide, you’ll learn how to trade binary options Philippines step by step — from choosing a broker to applying beginner-friendly strategies and managing risks wisely.

If you’re new to the market, we recommend first reading our Binary Options Trading Philippines Complete Guide pillar page to understand the fundamentals before diving into this practical walkthrough.

The first and most important step is selecting a reliable broker. Your broker acts as the trading platform where you deposit funds, execute trades, and withdraw profits.

What Filipino Traders Should Look For:

✔ Low minimum deposit (₱500–₱5,000 range)

✔ Accepts Philippine payment methods (GCash, bank transfer, cards)

✔ Demo account availability

✔ Fast withdrawals

✔ Mobile-friendly trading platform

✔ Clear payout percentages (usually 70%–95%)

Since binary options are not directly regulated by the Philippine SEC, it’s crucial to choose internationally recognized platforms with strong reputations.

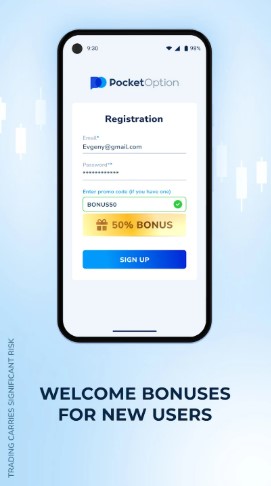

Step 2: Open and Verify Account

Once you’ve selected a broker, account registration usually takes less than 5 minutes.

Registration Process:

- Enter email address

- Create password

- Confirm email verification

- Complete personal details

Account Verification (KYC)

To withdraw profits, you must verify your identity. Brokers typically require:

-

Valid government ID (Passport, Driver’s License, UMID)

-

Proof of address (Utility bill or bank statement)

Verification usually takes 24–72 hours.

💡 Tip for Filipino traders: Make sure your name on the ID matches your payment method to avoid withdrawal delays.

Before depositing real money, explore the demo account to practice risk-free trading.

Step 3: Fund Your Trading Account

After verification, you can deposit funds.

Common Deposit Methods in Philippines:

-

GCash

-

Credit/Debit Cards (Visa/Mastercard)

-

Online Banking

-

Cryptocurrency (Bitcoin, USDT)

Minimum Deposit

Most brokers require $10–$50 (around ₱600–₱3,000).

Recommended Starting Capital

For beginners:

-

Start with ₱2,000–₱5,000

-

Risk only 1–5% per trade

Never deposit money you cannot afford to lose.

Step 4: Select Asset and Expiry Time

Binary options trading is based on predicting whether an asset’s price will go UP or DOWN within a specific time frame.

Popular Assets for Filipino Traders:

-

Forex pairs (EUR/USD, GBP/USD)

-

Commodities (Gold, Oil)

-

Indices (NASDAQ, S&P 500)

-

Cryptocurrencies (Bitcoin)

Expiry Time Options:

-

30 seconds

-

1 minute

-

5 minutes

-

15 minutes

-

1 hour

Shorter expiry = higher risk

Longer expiry = more stable decision-making

Example Trade:

-

Asset: EUR/USD

-

Investment: ₱500

-

Expiry: 5 minutes

-

Prediction: Price will go UP

-

Payout: 85%

If correct → ₱925 total return

If wrong → ₱500 loss

This simplicity is why many Filipinos are attracted to binary options trading.

Basic Strategies for Beginners

Even though binary options look simple, strategy matters.

Here are beginner-friendly approaches:

1. Trend Following Strategy

“Trend is your friend.”

-

Identify upward or downward trend

-

Trade in direction of trend

-

Use 5–15 minute expiry

Works best on forex pairs.

2. Support and Resistance Strategy

-

Identify price zones where market reverses

-

Trade reversal near key levels

-

Combine with candlestick confirmation

3. RSI Indicator Strategy

Relative Strength Index (RSI) measures overbought and oversold conditions.

-

RSI above 70 → Market overbought → Consider DOWN trade

-

RSI below 30 → Market oversold → Consider UP trade

4. News-Based Strategy (Advanced Beginners)

Economic news affects forex prices strongly.

Avoid trading during high volatility news unless experienced.

If you want deeper strategy insights, explore our complete Binary Options Strategies for Beginners Philippines guide linked from our main trading resource hub.

Risk Management Tips for Filipino Traders

Risk management separates profitable traders from gamblers.

1. Never Risk More Than 5% Per Trade

If you have ₱5,000 capital:

-

Maximum per trade = ₱250

2. Avoid Emotional Trading

Common mistakes:

-

Revenge trading

-

Increasing lot size after losses

-

Overtrading

Risk management separates profitable traders from gamblers.

1. Never Risk More Than 5% Per Trade

If you have ₱5,000 capital:

-

Maximum per trade = ₱250

2. Avoid Emotional Trading

Common mistakes:

-

Revenge trading

-

Increasing lot size after losses

-

Overtrading

Common Mistakes to Avoid

Many Filipino beginners lose money because of:

-

Believing “100% winning strategy” scams

-

Copying random Telegram signals

-

Trading without a plan

-

Using entire balance on one trade

Binary options are high-risk instruments. Always approach with discipline.

How Much Can You Earn?

Profit depends on:

-

Win rate

-

Risk percentage

-

Account size

Example:

-

Capital: ₱10,000

-

Risk per trade: ₱300

-

5 trades per day

-

60% win rate

With disciplined execution, steady growth is possible.

But remember:

There are losing days, weeks, and months.

Is Binary Options Trading Profitable in Philippines?

Yes — but only with:

-

Proper strategy

-

Strict risk control

-

Emotional discipline

-

Continuous learning

Most beginners lose because they treat trading as gambling. Successful traders treat it as a skill-based probability game.

Final Thoughts – How to Trade Binary Options Philippines

Learning how to trade binary options Philippines is easy. Becoming consistently profitable is not.

Follow these steps:

- Choose reliable broker

- Verify account properly

- Start with small capital

- Apply basic strategy

- Control risk strictly

Binary options can be a supplementary income stream — but never rely on it as guaranteed income.

Before you start trading, we strongly recommend reading our complete Binary Options Trading Philippines Guide to understand risks, broker selection, legality, and strategies in full detail.